Notes to the Financial Statements

Years Ended December 31, 2008 and 2007

NOTE A: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Nature of Operations

The Plant is a regulated municipal electric utility located in Taunton, Massachusetts. The Plant operates as an enterprise fund of the City of Taunton,

Massachusetts, and produces, purchases and distributes electricity to approximately 35,900 customers in the city of Taunton and the surrounding areas.

The Plant also operates an internet access business unit and provides services to approximately 1,700 customers.

Enterprise funds and similar component units apply Financial Accounting Standards Board (FASB) pronouncements and Accounting Principles Board (APB) opinions issued on or before November 30, 1989, unless those pronouncements conflict with or contradict Governmental Accounting Standards Board (GASB) pronouncements, in which case GASB prevails.

The Plant operates within the electric utility industry which has undergone significant restructuring and deregulation. In 1998, the Massachusetts Department of Public Utilities ("DPU") issued an electric industry restructuring plan, and the Massachusetts legislature created a special committee on electric industry restructuring. The ongoing changes in the industry and the resultant financial impact on the Plant are not determinable.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements

and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Estimates relating to the allowance for doubtful accounts and contingencies (see note F) represent significant estimates included in the financial statements. Management bases its estimates of these items on historical experience, specific identification and future expectations.

Rates

The Plant is under the charge and control of the Municipal Light Plant Commissioners in accordance with Chapter 164, Section 55, of the General Laws

of the Commonwealth of Massachusetts. Electric power is both produced and purchased and is distributed to customers within their service area. The

rates charged by the Plant to its customers are filed with the Department of Public Utilities ("DPU") and are subject to Chapter 164, Section 58,

of the General Laws, which provides that prices shall be fixed to yield not more than 8% per annum on the cost of the plant after repayment of operating

expenses, interest on outstanding debt, the requirements of any serial debt and depreciation.

The Plant’s rates include a Purchased Power Cost Adjustment (PPCA) which allows an adjustment of rates charged to customers in order to recover all changes in power costs from stipulated base costs. The PPCA provides for a quarterly reconciliation of total power costs billed with the actual cost of power incurred.

Depreciation

The provision for depreciation of utility plant was computed in 2008 and 2007 at 3% of the cost of plant in service at the beginning of the year, exclusive

of land and land rights. No depreciation is taken in the year of plant additions and a full year’s depreciation is taken in the year of disposal. Massachusetts

law stipulates that the Plant may change its depreciation rate from the statutory 3% only with the approval of the DPU.

Depreciation Fund cash is used in accordance with state laws for replacements, enlargements and additions to the utility plant in service.

Taxes

The Plant is exempt from federal and state income taxes as well as local property taxes. The Plant pays an amount to the City of Taunton in lieu of taxes.

That amount is voted annually by the Municipal Light Commission.

Nonutility Property

Nonutility property consists of the cost of property owned by the Plant, that is neither used nor held for future use in the utility service. The property was

purchased for the fiber to the premises project. The Plant subsequently decided not to pursue the project. The Plant is currently examining options for

disposing of the property. The carrying value of the property has been adjusted to the expected resale value. The estimated loss on disposal of the property

of $30,900 and $0 for the years ended December 31, 2008 and 2007, respectively, is reflected on the statement of revenue, expenses and changes in net assets.

Pension Plan

Substantially all employees of the Plant are covered by a contributory pension plan administered by the City of Taunton in conformity with State Retirement

Board requirements (see Note G).

Inventory

Materials and supplies inventory is carried at cost, principally on the average cost method.

Sick Leave Trust Fund

The Plant established a Sick Leave Trust Fund ("Trust") in 1982 for the financing of future sick leave payments. It is the Plant’s

intention that the Trust be funded to the extent of the Plant’s sick leave liability and that future sick leave expense will be paid by the Trust once full

funding is achieved. Full funding was achieved in 1999. The assets of the Trust are shown in the financial statements to provide a more meaningful

presentation, as the assets of the Trust are for the sole benefit of the Plant.

The investment funds are reported at fair value in the statements of assets, liabilities and net assets. Realized gains and losses, as well as changes

in value of the investment funds, are included in the statements of revenues, expenses and changes in net assets.

Net investment income for the Trust was approximately $326,000 and $305,000 in 2008 and 2007, respectively. The net expense for sick leave was

approximately $1,282,000 and $372,000 for years ended December 31, 2008 and 2007, respectively.

Investment in Seabrook

The Plant’s Investment in Seabrook represents a 0.10034% joint ownership share. The Plant records annually depreciation computed at 4% of the

initial investment in Seabrook. The Plant’s percentage share of new plant additions are capitalized and their share of operating and maintenance

expenses, and decommissioning expenses (see Note D) are charged against earnings.

Cash Equivalents

For purposes of the Statement of Cash Flows, the Plant considers all deposits with original maturities of three months or less to be cash equivalents.

Accounts Receivable

The Plant carries its accounts receivable at fair market value by way of an allowance for doubtful accounts. Collectibility of receivables is determined

based on historical write offs and collections, on knowledge of specific large accounts, and on current economic conditions.

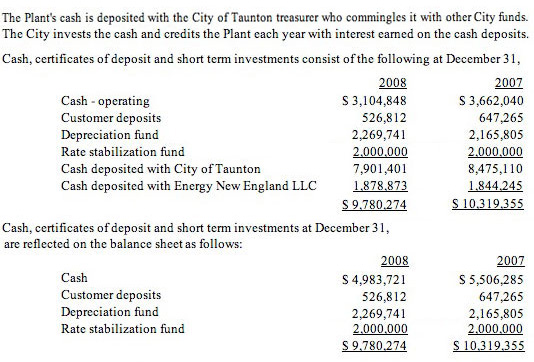

NOTE B: CASH AND CERTIFICATES OF DEPOSIT

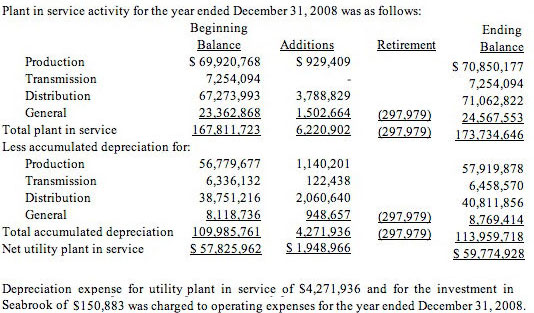

NOTE C: PLANT IN SERVICE

NOTE D: INVESTMENTS

Seabrook

The Plant is a 0.10034% joint owner of the Seabrook New Hampshire Unit 1.

The joint owners of Seabrook have established a Decommissioning Fund that is currently held by a Trustee. The Plant’s share of the estimated decommissioning liability is approximately $927,000 as of December 31, 2008 (the most current valuation date). The Plant is currently contributing, based on a present value formula, $1,005 per month over 25 years.

Energy New England

Energy New England, LLC (ENE) is an energy and energy services company established to assist publicly owned entities to ensure their continued viability in the deregulated wholesale electric utility markets and to strengthen their competitive position in the retail energy market for the benefit of the municipal entities. ENE functions as an autonomous, entrepreneurial business unit that is free from many of the constraints imposed on traditional municipal utility operations. As of December 31, 2006, the Plant owned a one third interest in ENE. On January 1, 2007, three new members joined ENE each receiving a 5% interest in the company. After the entry of the new members the Plant owns a 28.33% interest in ENE. Each of the members has one seat on the Board of Directors along with three outside Directors. The Plant’s initial investment in the company in 1998 was $500,000. The Plant records this investment under the equity method.

Included in other income is approximately $28,000 and $174,000 of gains for the years ended December 31, 2008 and 2007, respectively, representing the Plant’s share of ENE’s results of operations and capital adjustments in 2007.

Hydro Quebec Electric Company

In 1988, the Plant entered into an agreement with the Massachusetts Municipal Wholesale Electric Company and other New England Utilities and Hydro-Quebec Electric Corporation (Hydro Quebec). In connection with the agreement, the Plant advanced approximately $800,000 toward development of the project of which approximately $450,000 was returned after the project obtained financing. In 1991, the Hydro Quebec project was completed. Upon completion of this project, each participant received stock in the New England Hydro Transmission Electric Company and The New England Hydro Transmission Corporation proportional to their advances. The investment is being accounted for on the cost basis. The stock received is not readily marketable, but gives the holder rights to purchase power at a percentage of the fossil fuel rate. During the years ended December 31, 2008 and 2007, the Plant received dividends from the two companies of approximately $16,000 and $11,000, respectively.

NOTE E: OPERATING LEASES

The plant leases various equipment under leases with terms ending between 2010 and 2013.

The future minimum lease payments under these agreements at December 31, 2008, are as follows:

Rent expense under these leases, which is included in administrative and general expenses, was approximately $275,000 in 2008 and 2007.

2009 $275,065 2010 $217,603 2011 $45,217 2012 $45,217 2013 $45,217

NOTE: F COMMITMENTS AND CONTINGENCIES

Litigation and Other Matters

The Plant is involved in various legal matters incident to its business, none of which is believed by management to be significant to the financial condition or the results of operations of the Plant.

The Plant is also involved in proceedings relating to environmental matters. Although it is not possible to estimate the liability, if any, of the Plant related to these environmental matters, the Plant believes that these matters will not have a material adverse effect upon its financial condition or the results of operations.

The Plant has a program for insurance coverage provided by the Massachusetts Municipal Utility Self-Insurance Trust Fund ("Trust"). The insurance coverage provided by the Trust is in excess of a $50,000 self retention up to a maximum of $500,000 per occurrence. Additionally, coverage for certain environmental claims is provided by the Trust through a separate policy for which the plant is responsible for a $50,000 self-retention and the Trust covers the next $50,000. Above this combined $100,000 self-retention, the separate pollution liability policy provides coverage for certain claims up to $1 million per occurrence and $10 million aggregate.

Option Contracts

The Plant manages risk associated with power supply commitments and excess capacity by entering into forward contracts for the purchase and sale of electricity and fuel in the normal course of business. It also uses put and call option contracts to reduce the price risk associated with its power supply portfolio.

Put and call options are reflected at fair value as determined by actively quoted prices and are recorded on the balance sheet with changes in fair value included in purchased power and transmission expense. No option contracts were open as of December 31, 2008 or 2007.

Forward contracts to purchase electricity and fuel at set prices and other contracts to sell electricity at fixed prices qualify for the normal purchases and sales exception of SFAS No. 133 and are not accounted for as deriviatives.

The objectives of TMLP’s risk management procedures for option contract and power and fuel purchase and sale forward contract activities are to optimize power supply resources, control costs, and manage price volatility to customers while avoiding speculative positions in the commodities markets.

Power Contracts

The Plant has commitments under long-term contracts for the purchase of electricity from various suppliers. These wholesale contracts are generally for fixed periods and require payment of demand and energy charges. The total costs under these contracts are included in purchased power in the statements of revenues, expenses and changes in net assets and are normally recoverable in revenues under cost recovery mechanisms mandated by the Commonwealth of Massachusetts. The status of these contracts is as follows:

Estimated Annual 2008 KW Contract Minimum

FUEL KW YEAR COST Fuel - Hydro 4,845 2025 $ 2,073,000 Fuel - Methane 2,850 2014 $ 1,198,000 Fuel - Methane 1,150 2016 $ 535,000 Fuel - Methane 5,000 2020 $ 2,102,000 Fuel - Nuclear 1,170 2020 $ 381,000 Fuel - Unspecified 10,000 2010 $ 7,074,000

Note g: Pension Plans

The Plant contributes to the City of Taunton Retirement System (the "System"), a public employee retirement system that acts as the investment and administrative agent for the City. The System is a contributory cost-sharing multiple employer defined benefit plan. All full-time employees participate in the System.

Instituted in 1937, the System is a member of the Massachusetts Contributory System and is governed by Massachusetts General Laws Chapter 32. Membership in the System is mandatory upon the commencement of employment for all permanent, full-time employees.

The System provides for retirement allowance benefits up to a maximum of 80% of a member’s highest three-year average annual rate of regular compensation. Benefit payments are based upon a member’s age, length of creditable service, level of compensation and group classification.

Members of the System become vested after 10 years of creditable service. A retirement allowance may be received upon reaching age 65 or upon attaining twenty years of service. The System also provides for early retirement at age 55 if the participant (1) has a record of 10 years of creditable service, (2) was on the City’s payroll on January 1, 1978, (3) voluntarily left City employment on or after that date, and (4) left accumulated annuity deductions in the fund. Active members contribute either 5%, 7%, 8% or 9% of their regular compensation depending on the date upon which their membership began. The System also provides death and disability benefits.

The System assesses the City each fiscal year an amount determined in accordance with its current funding schedule. The City allocates a portion of its obligation to the Plant based on the relative number of participants and the amount of payroll. The Plant’s contributions to the System for 2008, 2007 and 2006 were $2,796,600, $2,646,530 and $2,493,792, respectively, and were the equivalent to the required payments.

The current funding schedule includes the amount required to pay the employer normal cost (in addition to member contributions) plus the amortization of the prior unfunded actuarial accrued liability. The current funding schedule projects that the plan will be fully funded in 2028. The funding schedule has been approved by the Public Employees Retirement Association.

Copies of the System’s audited financial statements can be obtained by writing to The City of Taunton Retirement System, 40 Dean Street, Taunton, MA 02780.

The Plant has established a separate Employees Retirement Trust Fund ("Trust Fund") for the financing of future pension payments. The market value of the net assets at December 31, 2008 and 2007, was approximately $8,261,000 and $9,499,000, respectively. These funds are invested in money market funds, fixed income securities including government and corporate bonds and other equity securities. The Plant made no contributions to the Trust Fund in 2008 and 2007.

The Plant pays the normal costs plus expenses and a levelized amount of the amortization. The Plant receives from the Trust Fund, over the next sixteen years, the balance of the annual amortization of the unfunded pension liability. Prior to 2007, the Plant received 100% of the annual amortization of the unfunded pension liability from the Trust Fund.

The following represents the components of the Plant’s recorded pension expense.

December 31,

2008 2007

Contributions assessed by and paid to the System $ 2,796,600 $ 2,646,530

Contributions from the Trust Fund (547,771) (501,550)

Recorded pension expense $ 2,248,829 $ 2,144,980