Management’s Discussion & Analysis

Within this section of the City of Taunton, Massachusetts, Municipal Lighting Plant annual financial report, management provides narrative discussion and analysis of the financial activities of the Municipal Lighting Plant for the year ended December 31, 2008. The Plant’s performance is discussed and analyzed within the context of the accompanying financial statements and disclosures following this section.

Overview of the Financial Statements:

The basic financial statements include (1) the statements of assets, liabilities and net assets (2) the statements of revenues, expenses and changes in net assets (3) the cash flow statements and (4) notes to the financial statements.

The Statement of Assets, Liabilities and Net Assets is designed to indicate the Plant’s financial position as of a specific point in time. At December 31, 2008, it shows our net worth of $80,694,416 which is comprised of $64,167,702 invested in capital assets, $2,269,741 restricted for depreciation and $14,256,973 available for operations.

The Statement of Revenues, Expenses and Changes in Net Assets summarizes our operating results for the years ended December 31, 2008 and 2007. As discussed in more detail below, the Plant’s net income for 2008 and 2007, was $4,606,986 and $4,159,598 respectively, before payments in lieu of taxes (PILOT).

The Statement of Cash Flows provides information about the cash receipts and cash payments during the accounting period. It also provides information about the investing and financing activities for the same period. A review of the Plant’s Statements of Cash Flows indicates that the cash receipts from operating activities, (that is, electricity and internet access sales and related services) were sufficient to cover the operating expenses and capital projects. Investing activities and prior year’s cash balances were used to provide contributions to the City in 2008.

Summary of Net Assets

| Revenues & Expenses | 2008 | 2007 |

| Current Assets | $21,909,214 | $21,144,972 |

| Noncurrent Assets | 75,925,084 | 74,004,205 |

| Total Assets | $97,834,298 | $95,149,177 |

| Current Liabilities | 6,289,293 | 7,100,592 |

| Noncurrent Liabilities | 10,850,589 | 9,061,155 |

| Total Liabilities | 17,139,882 | 16,161,747 |

| Invested Capital Assets | 64,167,702 | 61,785,528 |

| Restricted for Depreciation | 2,269,741 | 2,165,805 |

| Unrestricted | 14,256,973 | 15,036,097 |

| Total Net Assets | 80,694,416 | 78,987,430 |

| Total Liabilities and Net Assets | $97,834,298 | $95,149,177 |

Summary of Changes in Net Assets

| 2008 | 2007 | |

| Operating Revenues | $109,519,331 | $94,328,244 |

| Operating Expenses | 105,012,163 | 92,014,273 |

| Operating Income | 4,507,168 | 2,313,971 |

| Nonoperating Revenues Less Nonoperating Expenses | 99,818 | 1,845,627 |

| Increase in Net Assets before Transfers | 4,606,986 | 4,159,598 |

| Transfers Out - Payment in lieu of taxes | -2,900,000 | -2,825,000 |

| Increase in Net Assets | $1,706,986 | $1,334,598 |

Financial Highlights:

Operating revenues for 2008 increased by $15.2 million or 16% from 2007. The increase is attributable to the recovery of increased power supply costs through the Purchased Power Cost Adjustment (PPCA).

Operating expenses for 2008 increased by $13 million or 14.1% from 2007. The increase is attributable principally to an increase in power supply costs (fuel, purchased power and transmission expenses).

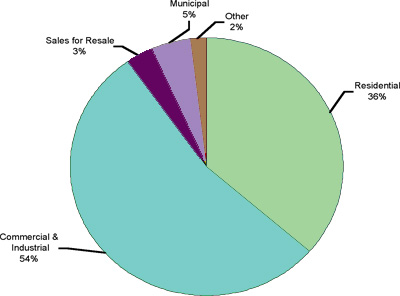

Source of 2008 Operating Revenues

Utility Plant and Debt Administration

Utility Plant

There was an increase in net utility plant of $1,949,000 for 2008. This increase is the difference between the current year additions of $6,221,000 and the annual depreciation (3% of depreciable gross plant) expense of $4,272,000. Additions to plant consisted principally of approximately $1 million in production plant, $3.8 million in distribution plant and $1.4 million in general plant. Major items capitalized in 2008 include TMLP’s security project, the National Pollutant Discharge Elimination System (NPDES) project, purchase of transformers and additions to the vehicle fleet.

Debt Administration

The Plant was debt free in 2008. Capital projects have been financed through current earnings.

Significant Balances and Transactions

Depreciation Fund

The Plant maintains this fund to pay for capital investments and improvements. These capital items are paid from the operating fund, which is then replenished by funds transferred from the depreciation fund. The depreciation fund is required by state statute. The Light Plant must set aside 3% of its gross depreciable plant annually to be used principally for capital expenditures. Interest earned on the account is kept in the fund.

Sick Leave Trust Fund

The Plant established a Sick Leave Trust Fund ("Trust") in 1982 for the financing of future sick leave payments. It is the Plant's intention that the Trust be funded to the extent of the Plant's sick leave liability and that future sick leave expense will be paid by the Trust. Full funding of the Trust was achieved in 1999.

Pension Plans

The employees of the Light Plant participate in the City of Taunton Retirement System. In addition to investments made by the System, a separate trust fund has been established by the Plant to provide funding of the Plant’s past unfunded service costs. Each year the Light Plant is assessed by the City for its share of such pension costs.